Curiosity is our greatest asset.

Learning, our favorite return.

What we do

We invest across Listed Equities, Private Credit, and VC.

How we do it

We are a group of friends actively learning how markets operate by making small investments. We align our interests with the growth of entrepreneurs, to foster a reciprocal relationship of learning and constructive feedback.

Why we do it

Our mission is to maximize learning and capital compounding rates, enabling us to fuel the pursuit of entrepreneurial ventures.

Listed Equities

Performance

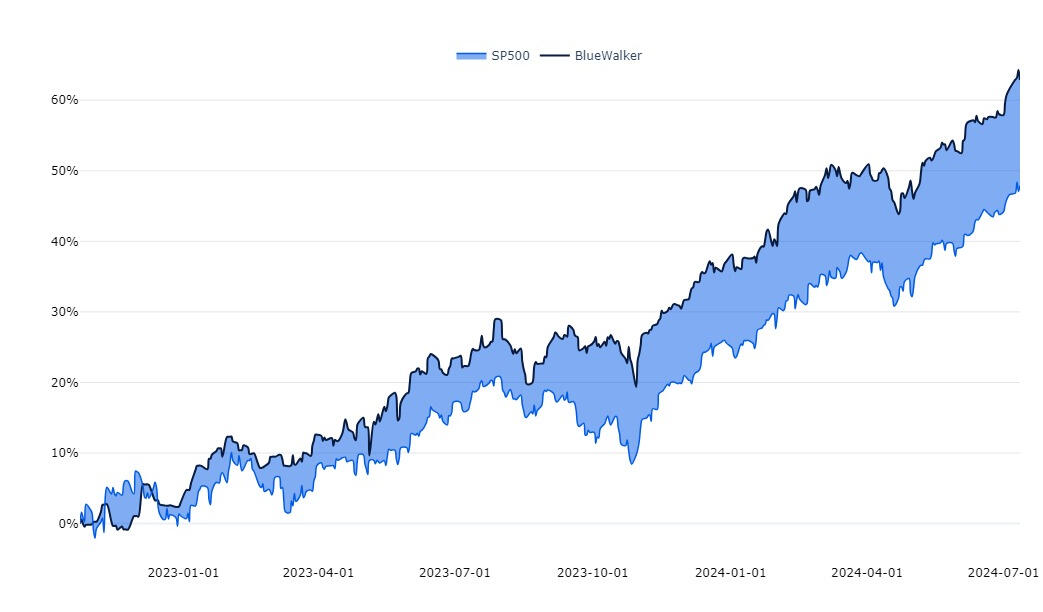

| Year | SP500 | BlueWalker | Excess Return |

|---|---|---|---|

| 2021 | +26.89% | +22.5% | -4.39% |

| 2022 | -19.44% | -0.82% | +18.62% |

| 2023 | +24.73% | +34.05% | +9.32% |

| 2024 |

4+Years Investing

€500KAUM

45Companies

17%3 year CAGR

€1-20KTicket Size

3xVenture TVPI

We are a focused, hungry and committed team.